Financial Management

Our expectation is the same as yours - to be there for you when you need us. We specialize in creating specific strategies that address complex wealth management issues, such as minimizing tax implications, so you can effectively control the destination and purpose of your wealth.

We anticipate issues proactively, strategize for comprehensive results and, above all, are ever-present and committed to your success. Today’s market complexity and volatility demands specialized attention, with a holistic approach to wealth management.

We provide the intellectual capital and resources needed to offer a truly dynamic approach to your investment objectives. We can engage a network of trusted professionals—such as accounting, legal, real estate, and insurance professionals—to support all facets of your wealth management needs.

Investment Management

Today’s investors have an important decision to make when choosing a portfolio manager: do they want a manager who follows a Passive approach, investing fixed percentages primarily between stocks, bonds, and cash or an Active manager with the flexibility and latitude to adjust broad allocations between a wide range of asset classes as market and economic conditions change? We have the flexibility in our managed portfolios to seek investment opportunities across a broad spectrum of asset classes and strategies.

Strategy Selection

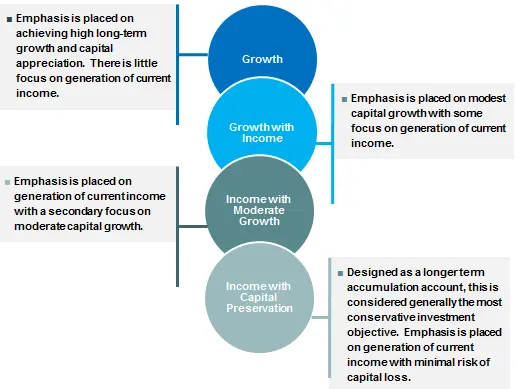

Our investment strategies offer investors a stand-alone strategy to fulfill a specific objective. All portfolios are actively managed utilizing the 4-Step investment management process outlined below:

4-Step Investment Management Process

Step 1: Determine the appropriate mix of stocks, bonds, and other asset classes for each portfolio based on current market conditions and our forward looking assessment of the investment landscape.

Step 2: Identify the most effective way to gain exposure to the asset classes we want to own.

Step 3: Utilize multiple analytical tools to help optimize our buy/sell decision-making process and to make tactical adjustments to portfolio asset classes.

Step 4: Continuously stress-test portfolios against both historical and forward-looking scenarios to assess the risks of major macro-economic or geopolitical events.

Custom Portfolio Management

We know costs and taxes can change everything—particularly for the high-net-worth investor. We can develop a highly personalized approach by combining internally managed strategies with rigorously selected third party managers. Customizing a portfolio generally involves customizing the tax management, the investment target, and incorporating outside constraints. We begin with a thorough understanding of your unique goals, risk tolerance, tax situation, return expectations and liquidity requirements. Then we carefully construct an investment plan created to help you work towards your objectives and manage your wealth according to your evolving circumstances.

Examples of customization

Personalized Tax Management-Your portfolio can be built around pre-existing securities allowing you to avoid selling positions unnecessarily. Additionally, capital losses can be harvested on an ongoing basis to help reduce your tax bill and invest more tax-efficiently. For individuals with large low cost basis positions, gain budgets can be established to allow for a multi-stage diversification process.

Personalized Security/Industry Exposure-Your portfolio can exclude specific securities or industries based on your needs. This is ideal for individuals who already have significant exposure to a particular stock/industry through various employer plans or would like to exclude certain investments for social reasons.

Asset Allocation does not ensure a profit or protect against a loss. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The information in this material is for information purposes only and is not intended to be specific advice. There is no "right" time to enter or exit a market. There is no guarantee that the investment objective will be met. More frequent buying and selling of assets may general higher transaction cost. Investors should consider the tax consequences of moving positions more frequently.

The investment objectives are overall objectives for the entire account and may be inconsistent with a particular holding at any time. Please note that achievement of the stated investment objectives is a long-term goal for the account.

Active portfolio management, including market timing, can subject longer-term investors to potentially higher fees and can have a negative effect on long-term performance due to the transaction costs of short-term trading. In addition, there may be potential tax consequences from these strategies. Active portfolio management and market timing may be unsuitable for some investors depending on their specific investment objectives and financial position. Active portfolio management does not guarantee a profit or protect against a loss in a declining market.

Estate and Legacy Planning Strategies

How much thought have you given your legacy?

Your wishes for how your wealth effects the next generations may be transparent, but translating those wishes into reality can be difficult. While many new clients may have taken the time to meet attorneys to have documents prepared, they may have not adequately re-titled assets or updated their chosen beneficiaries, creating serious risks to their overall estate plan.

We will help you understand how your assets will be distributed under your current estate plan and existing tax law. Our team will work with your estate planning attorney to formalize your wishes and explore alternatives for minimizing projected estate taxes and related settlement costs, such as titling assets, using trusts, lifetime gifting strategies and charitable planning.

Additional estate planning considerations include:

- Power of Attorney

- Living Will

- Health Care Power of Attorney

- HIPAA Authorization

Silverleaf Wealth Management and Integrity Advisory Solutions do not provide legal advice or services. Please consult your legal advisor regarding your specific situation.